Customs Audit Regulations 2018

Whether the goods are for your own personal use. 442019-Customs NT dated 19th June 2019 and Circular 382018-Customs dated 18102018 issued to streamline the procedure documentation and.

Guide To Tax Audit Finance Act 2018 Law Books Corporate Law Finance

Bond Book Part 04 Publish Date.

. Branch Chief FOIA Appeals Policy Litigation. SMETA Sedex Members Ethical Trade Audit is an ethical audit methodology which encompasses all aspects of responsible business practice. Bond Book Part 02 Publish Date.

CDS will replace the existing Customs Handling of Import and Export Freight CHIEF. When you bring goods into Fiji you may need to pay Customs duty and other charges on your arrival. January 13 2014 Forms.

The OMB Date is expired however this form is still valid for use and is under review by OMB awaiting a new expiration date. Branch Chief Customs. More 115 17052019 GST Guide On Tax Invoice Debit Note Credit Note And Retention Payment After 1st September 2018.

A link to the Accountancy sector guidance for money laundering supervision based on law as of 13 July 2021 has been added. Was founded in Dubai United Arab Emirates in 1985. Form 339A C and V - Online Decal User Fee - DTOPS Decal and Transponder Online Procurement System Form.

Form 301 - Customs Bond. State whether sales tax customs duty excise duty or any other indirect tax levy cess impost etc. Conference of Chief Commissioners of Customs and Directors General on Customs Tariff and Allied Matters was held in New Delhi from 4th to 5th March 2018.

Whether they are covered by a concession or duty-free allowance. The detailed guidance given in these publications of. More 117 02052019 Borang SST-ADM.

1681 et seq Section 504 of the Rehabilitation Act of 1973 29 USC. Title VI of the Civil Rights Act of 1964 42 USC. Feedback within 21 days then the audit will be conducted as usual.

A companyindividual who has received a letter of Request to Submit DocumentsRecords for Auditing Purpose or has had an Audit Visit has by RMCD Audit Team to their premise are being audited. Gradation List of ARO Publish Date. Title 19 was last amended 8192022.

More 116 10052019 Compliance Audit Framework. The PDF version of the Accountancy sector guidance for money. What you pay will depend on a number of factors such as.

The Electronic Code of Federal Regulations. Clause 26 related to section 43B of Income Tax Act 1961 has two sub clauses. Is passed through the profit and loss account Analysis.

We are an ISO certified company. Sub Clause A talks about the liabilities which exist on the first day of the previous year. 332018 dated 2072018 effective from 2082018 Technical Guide on Income Computation and Disclosure Standards.

794 and the Age Discrimination Act of 1975 42 USC. This checklist has been broadly based on the text of the Guidance Note on Tax Audit under section 44AB of the Income tax Act 1961 Implementation Guide wrt. Whether they are for.

Transfer Pricing Regulations 2012 LI 2188 Indirect Tax Withholding Vat Return WHVAT DT 0137 Monthly VAT NHIL COVID-19 Flat Rate Return ver10 DT 0135 VAT NHIL COVID-19 Standard Rate Return Form 20082018 ver15 Non-resident Monthly Return REVISED VAT NHI GETFund COVID-19 HEALTH RECOVERY LEVIES DT 0138 Monthly NHIL GET Fund LEVY. As a multi-stakeholder initiative SMETA was designed to minimize duplication of effort and provide members and suppliers with an audit format they could easily share. Displaying title 19 up to date as of 8242022.

6101 et seq which. HM Revenue and Customs HMRC will begin a phased launch of the Customs Declaration Service CDS in August 2018. We collect Customs charges on goods coming into and going out of Fiji.

Data Protection Charges and Information Regulations 2018 SI. National Health Service General Medical Services Contracts Scotland Regulations 2018 SSI. Written Examination under Custom Brokers Licensing Regulation2013 held on 19012018- Declartion of Result-Regarding.

Title 19 This content is from the eCFR and is authoritative but unofficial. Enhanced content is provided to the user to provide additional context. Companiesindividuals that are being.

SMETA reports are published in the SEDEX system. Bond Book Part 01 Publish Date. Bond Book Contents Publish Date.

2000d et seq Title IX of the Education Amendments of 1972 20 USC. National Commodity Specialist Division New York. CBP Form 0301pdf Tags.

HMRC was formed by the. Her Majestys Revenue and Customs HM Revenue and Customs or HMRC is a non-ministerial department of the UK Government responsible for the collection of taxes the payment of some forms of state support the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. However Farahat Co is a regulated audit firm in Dubai listed with Dubai International Financial Centre DIFC as an approved financial auditorliquidator and is also listed with Dubai Abu Dhabi and UAE Courts as an expert witness and also as a regulated liquidator.

1 July 2022. Undertaken in bonded warehouses under section 65 of the Customs Act-reg. PPT on IPR by.

Bangladesh Customs Modernization Strategic Action Plan 2019-2020. GST Guide On Declaration And Adjustment After 1st September 2018. MadamSir Please refer to the Manufacture and Other Operations in Warehouse Regulations 2019 issued vide Notification No.

More 118 22042019. Branch Chief Border Security Regulations. Bond Book Part 03 Publish Date.

Branch Chief Disclosure Law Judicial Actions.

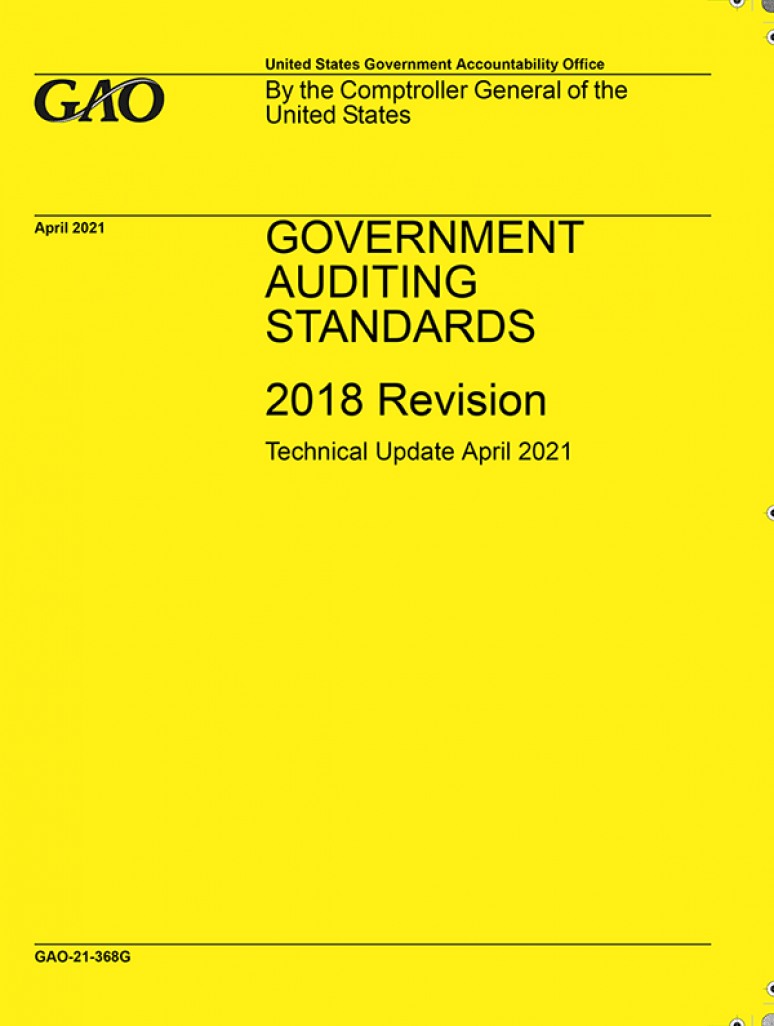

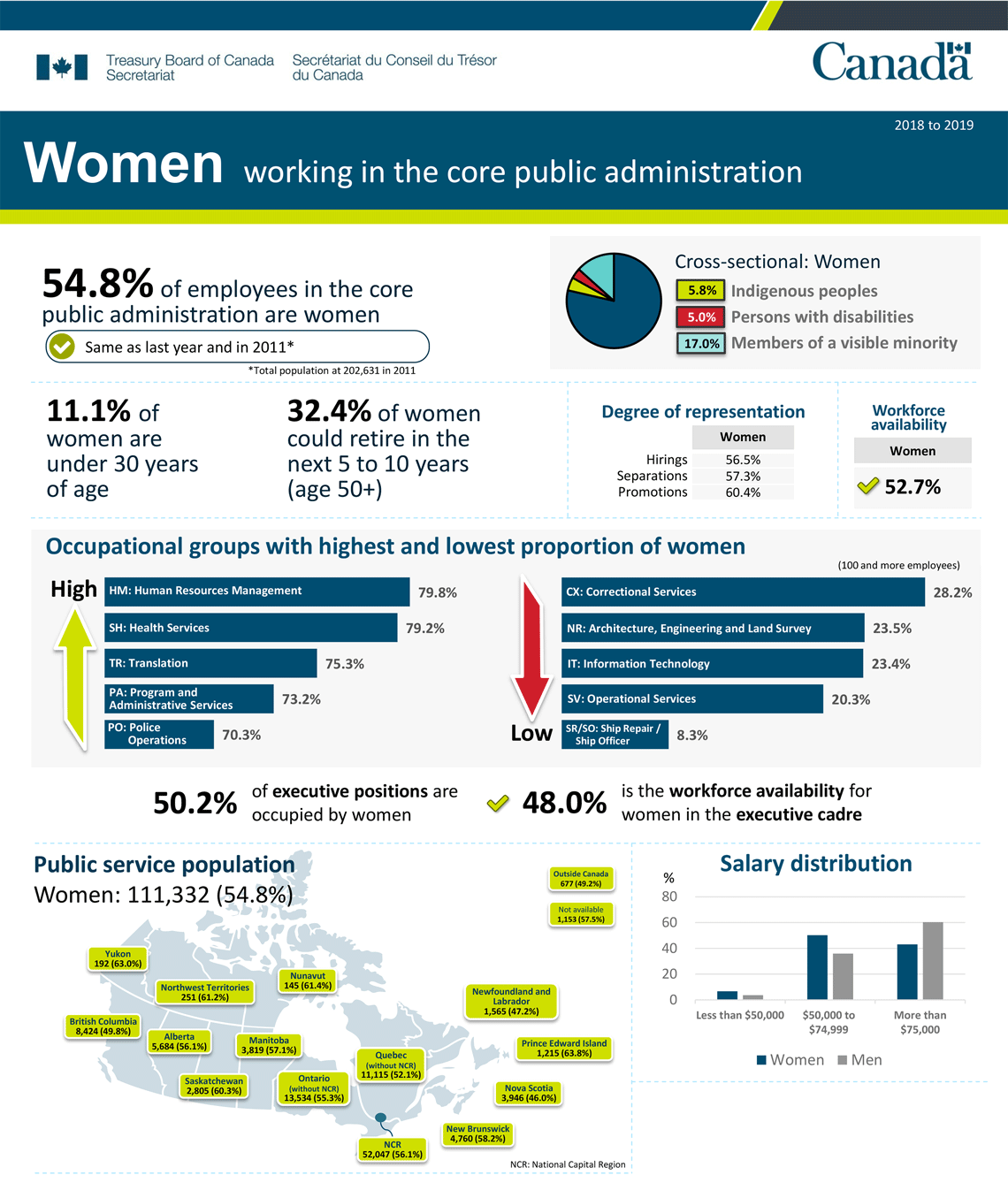

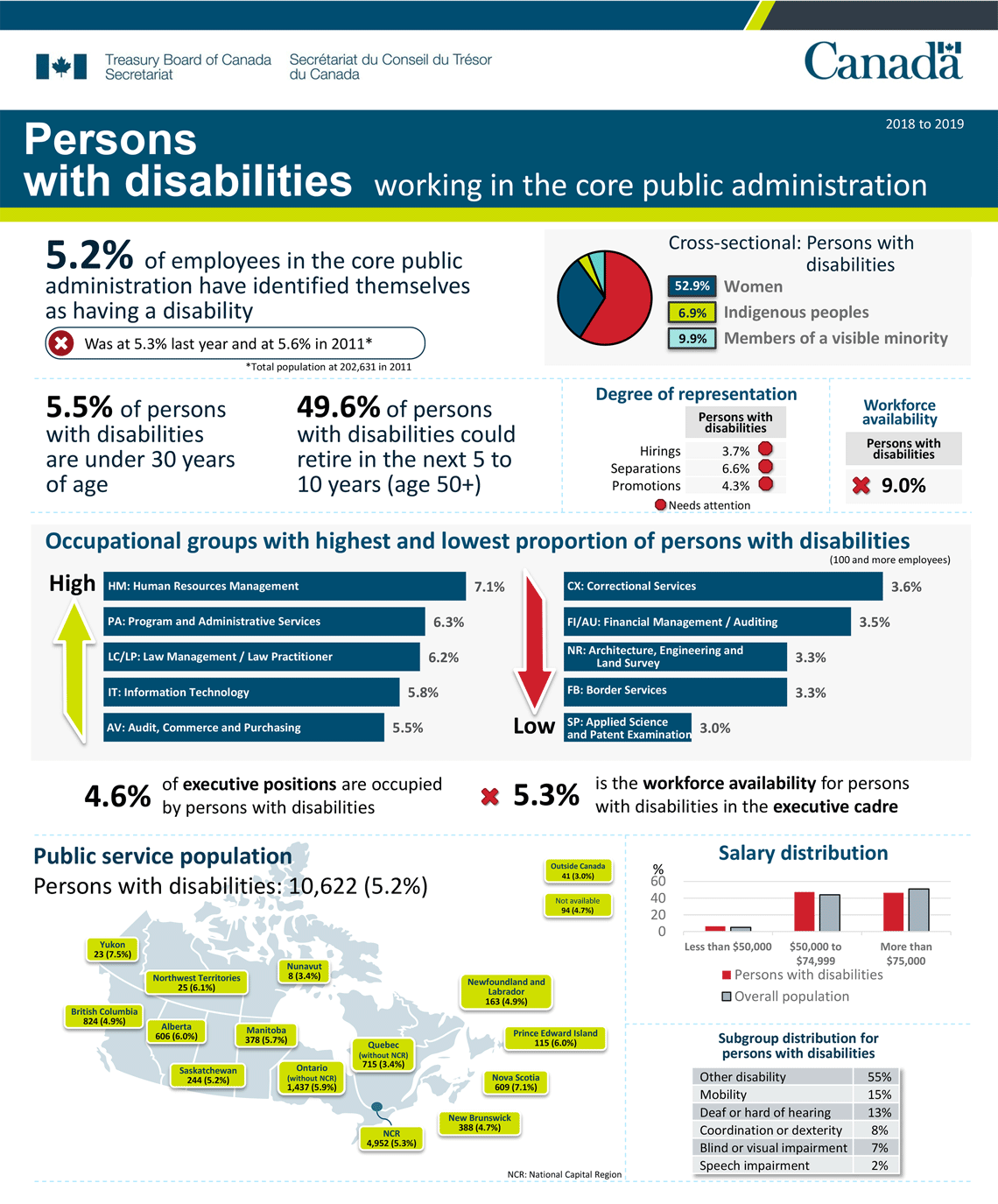

Employment Equity In The Public Service Of Canada For Fiscal Year 2018 To 2019 Canada Ca

Employment Equity In The Public Service Of Canada For Fiscal Year 2018 To 2019 Canada Ca

Custom Services In 2022 Custom Consulting Business Customs Service

Employment Equity In The Public Service Of Canada For Fiscal Year 2018 To 2019 Canada Ca

Company Law Manual A Compendium Of Companies Act 2013 Along With Relevant Rules Buybooksonline Www Meripustak Com Pi Law Books Books Online Corporate Law

Government Auditing Standards 2018 Revision Technical Update April 2021 U S Government Bookstore

0 Response to "Customs Audit Regulations 2018"

Post a Comment